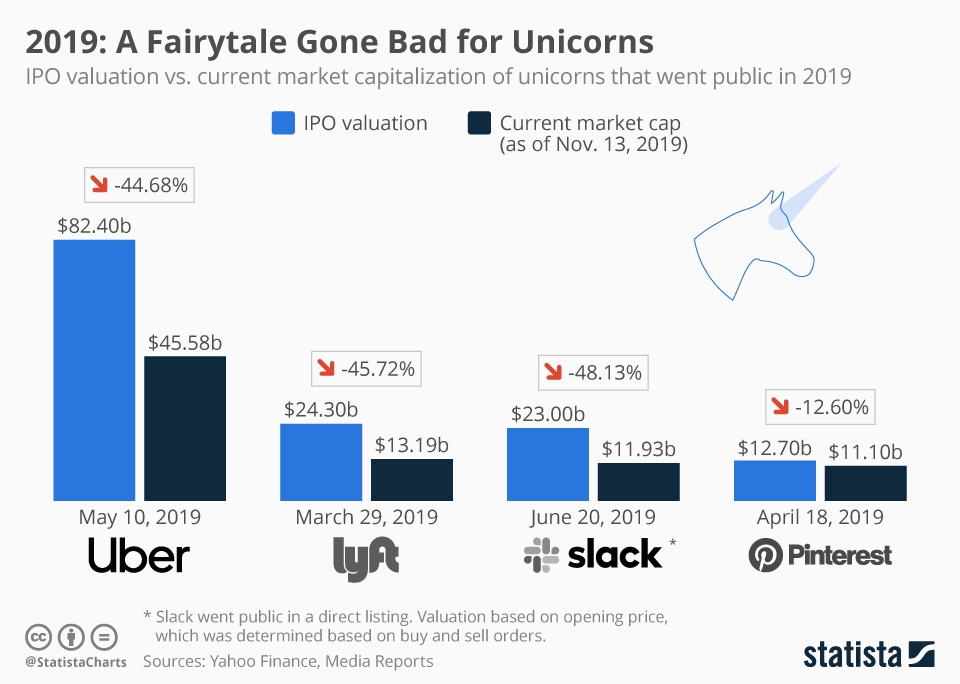

In an attempt to soar higher in terms of growth, a few unicorns have decided to go public, only for their hopes to be shattered by their poor IPO performances.

From our partners:

Going downhill

Lyft went public last March 29, with their IPO valuation set at $24.30B. Their stock fell quickly to $13B, a sharp decline of 45.72%. Lyft went public a month before its rival, Uber. The anticipation over Uber going public has greatly contributed to the downfall of their stock.

Nevertheless, going public has turned out real ugly for Uber as well. The company went public May 10 this year, with an initial IPO valuation of $80B, one of the highest valuations to have ever hit the market. It has since gone down to a $45.59B, a tremendous dip.

According to Jordan Hiscott, a chief trader trader at Ayondo Markets in an interview with The Guardian, “I find it intriguing that investors would want to participate with this valuation as high as $82B, while still being a loss-making company.”

A month later, Slack Technologies also decided to go public through a direct listing. Starting with an initial valuation of $23B, their stock has plummeted to $11.93B, down by 48.13%. Microsoft Team’s continuous growth is the biggest hurdle in Slack’s way, having pulled in over 20 million active users now — way ahead of Slack’s estimated 12 million.

Pinterest is another unicorn which debuted this year, with an IPO valuation of $12.70B. While Pinterest started out smooth sailing, it has since experienced losses, with their stock now only with $11.70B.

A healthy dose of ambition

The current market environment is more volatile than usual for IPOs. We have the on-going US-China trade war, the slowdown in economic growth, and the upcoming 2020 US Presidential elections. With so much more factors to consider, there really is no wonder why there is hesitation to invest on companies going public, especially those who are primarily driven by further growth rather than gaining actual profit.

With so much tech companies involved in these slumps in the stock market, we can expect the performance of tech companies going public in the future to be equally affected.

The stock market has never been a forgiving environment. Going public propelled some companies, it has caused the fall of the others.

While a healthy dose of ambition is needed in order to reach new heights, some level of caution must be exercised in going public. As it turns out, not even those at the very top are safe.

For enquiries, product placements, sponsorships, and collaborations, connect with us at [email protected]. We'd love to hear from you!

Our humans need coffee too! Your support is highly appreciated, thank you!