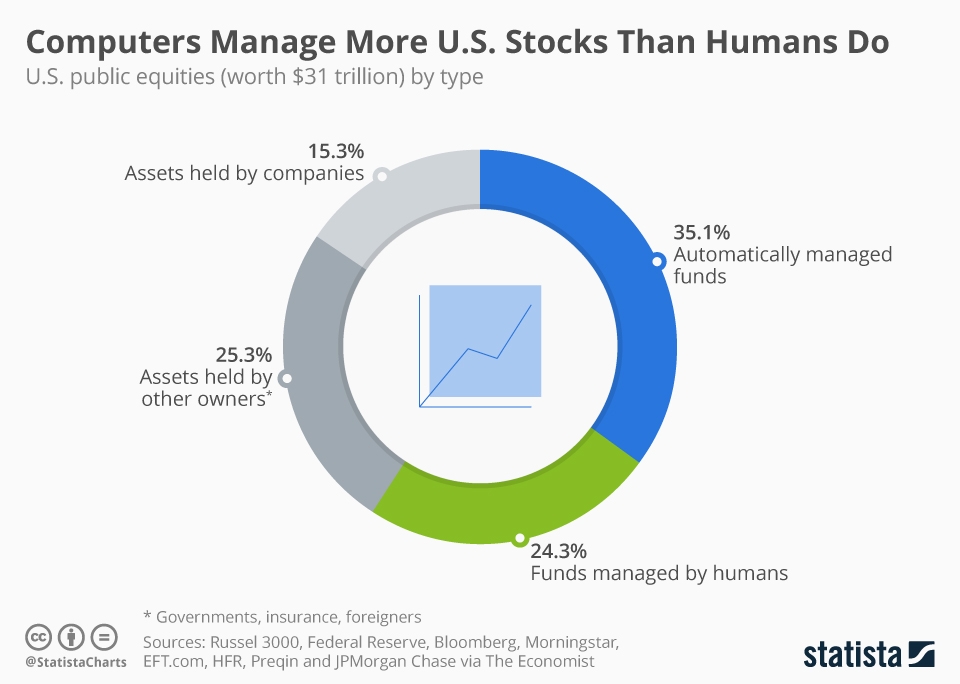

Computers completely overtook humans in terms of the proportion of stocks being managed. This is what is revealed by a recent study of The Economist.

From our partners:

35.1% of the US stock market is now being managed by algorithms. Meanwhile, 24.3% of the stock market is still being handled by humans.

The remaining portion of the stock market are assets held by companies (15.3%) and other owners such as governments, insurance, and foreigners (25.3%).

In order to come up with these statistics, The Economist studied US$31 trillion worth of equities and checked which entity governs each portion.

Understandable shift

The stock market is an extremely volatile environment which demands constant supervision and quick decision making. There is a lot of risks involved when it comes to handling stocks. A single misstep could cost a fortune or possibly even the collapse of the entire market.

Until recently, stock trading has been a human-centric affair. While this has worked for quite a while, there are still instances that humans commit grave errors and misjudgment.

This is why it is perfectly understandable why there is a preference for automated stock management. Through algorithmic trading, human error is eliminated and all relevant factors when making stock-related decisions are all easily taken into account.

By modelling stock trade information, valuable predictions can also be made by these algorithms, something that humans cannot replicate.

The number one risk

While all seems to be good when it comes to the use of algorithms for managing passive equities, there are some who remains to be skeptical about its credibility.

Torsten Slok, chief international economist at Deutsche Bank, listed the risks to look out for in the stock market:

Number one in the list is “algo-driven, risk-parity driven fire sale in equities and credit discontinues.”

Especially with its current sphere of influence, algorithmic trading has the potential to spark huge, concentrated equity sell-offs. During times of market swings, volatility can be worsened due to this.

The fear of the critics of algorithmic trading is that its data centrism might eventually lead to extremely bad decisions that can ruin the stock market. This is a sentiment echoed by Omega Advisors CEO Leon Cooperman in his discussion of market volatility.

While modelling the stock market behaviour using sophisticated statistical models are beneficial in gaining insights, the results of these models should of course not be taken as absolutes. In the end, these models can still yield erroneous results.

With this in mind, the results of these algorithms should be taken as guides that are used along with human understanding to make the best decisions. Just by relying on one or the other will end up badly.

While it does in no way completely eliminate tot take big risks, it is in the synergy of the human experience and the computing power of these algorithms where the optimal decisions when it comes to the stock market can be found.

For enquiries, product placements, sponsorships, and collaborations, connect with us at [email protected]. We'd love to hear from you!

Our humans need coffee too! Your support is highly appreciated, thank you!