Kubernetes is Used in Production by 72% in China

At CNCF, we regularly survey our community to better understand the adoption of open source and cloud native technologies. For the third time, we conducted the Cloud Native Survey China in Mandarin to gain deeper insights into the pace of cloud native adoption in China, and how that’s empowering developers and transforming development in this large and growing community. This report builds on the first two China reports, published in March 2018 and November 2018.

From our partners:

Key Takeaways of Cloud Native Survey China

- 49% of respondents use containers in production, with another 32% planning to do so. This is a significant increase from November 2018 when only 20% used containers in production.

- 72% of respondents use Kubernetes in production, up from 40% in November 2018.

- The use of public cloud dropped to 36% from 51% in November 2018, replaced by a new option of hybrid with 39%.

- The use of CNCF projects is growing exponentially. CNCF now hosts four projects that were born in China and are more broadly used in the region: Dragonfly and KubeEdge, which are incubating, and Harbor and TiKV, which recently graduated.

The Cloud Native Survey China 2019 included responses from 300 people – 97% of which were in Asia, predominantly in China.

Container Usage

We know that containers have transformed cloud-based infrastructures but, over the last year, container use in production has become the norm. According to our global 2019 Cloud Native Survey, which we released earlier this year, 84% of respondents use containers in production, making container use ubiquitous across the globe.

The China survey indicates that while container usage in China lags behind global adoption, it is gaining momentum. Nearly half (49%) of respondents in the China survey use containers in production – a jump from 32% in our March 2018 survey and from 20% in November 2018.

Far fewer members in China plan to use containers in production – 32% versus 57% in our March 2018 survey and 40% in November. This means many organizations have put container plans into action and are no longer in the planning stage. However, there is still room for growth, which we fully expect to continue.

As use in production grows, the presence of containers in testing environments has dropped. About 28% of China survey respondents are currently using containers in testing – up slightly from 24% in March 2018 but down against 42% in the November 2018 survey.

While containers bring phenomenal advantages, they still pose challenges. These have changed over time, but the challenge of complexity has remained consistent. In the China survey, complexity was named the top challenge by 53% of respondents – compared to 44% in our March 2018 survey, where it was also top, and 28% in November 2018, where it ranked third.

Security ranked second in terms of challenges, with 39% of respondents. It was the first time security was listed as a top challenge. Lack of training and networking tied for third at 36%, while reliability and monitoring were chosen as deployment challenges by 35% of survey respondents.

Kubernetes Growth

Kubernetes is emerging in the industry as a common platform for container orchestration, and the CNCF community in China has seen a massive spike in adoption. 72% of respondents reported using Kubernetes in production – a dramatic increase from 40% in November 2018.

Consequently, the number of those evaluating Kubernetes has fallen, dropping to 17% from 42%.

We also see growth in the size of production clusters of Kubernetes at both ends of the deployment spectrum. Most organizations responding to the China survey are using fewer than 10 clusters, but there has been an increase in those running more than 50. This is likely driven by the number of new respondents using containers in production, while those using production containers are adding more clusters.

Thirty-six percent of respondents had two to five clusters, up from 25% in November 2018, with half using between one and five and 70% between one and 10. Just over 13% had more than 50 clusters in production versus 5% in November 2018.

Packaging

Helm is the most popular method of packaging Kubernetes applications, chosen by 54% of respondents.

Ingress

NGINX (54%) was the most used Kubernetes ingress provider, followed by HAProxy (18%), F5 (16%), and Envoy (15%).

Separating Kubernetes Applications

Managing objects in a cluster can be a challenge, but namespaces help by filtering and controlling them as groups. 71% of respondents separate their Kubernetes applications with namespaces. Of those that use Kubernetes with multiple teams, 68% use namespaces.

Monitoring, Logging, and Tracing

It is more common for those using monitoring, logging, and tracing solutions to run on-premise vs. hosted via a remote server. 46% of respondents use monitoring tools on-premise, while 20% run them via a remote service. Fewer respondents use logging and tracing overall, but 26% run tracing on-premise vs. 20% via a remote service. 21% run tracing tools on-premise and another 21% via a remote service.

Code

The speed of development and deployment has accelerated in China thanks to the combined power of cloud and containers, supported by Continuous Integration (CI) and Continuous Delivery (CD). Our survey quantifies development speed by the frequency developers check in code into repositories. Just over a third, 35%, check in code multiple times a day. 43% percent check in code a few times a week, and 16% check in a few times each month.

Most respondents work to weekly release cycles (43%) while just over a fifth (21%) work on monthly cycles, and 18% on daily cycles. 12% of those surveyed are working to ad-hoc schedules.

CI/CD

Many consider the foundation of successful CI/CD to be the automation of processes. However, our China survey revealed that purely automated environments are relatively rare – just 21% are employing automatic release cycles, with 31% relying on manual processes. The most popular response was hybrid, with 46%.

CI/CD is the philosophy and technology that enables agile and flexible delivery and lifecycle management of cloud native systems. The most popular CI/CD tool with the China community, Jenkins, is used by just over half of the community, 53%, and GitLab is used by 40%.

Cloud vs. On-Premise

Cloud is growing, but this year’s China survey revealed a shift away from public cloud, consolidation of private, and the emergence of hybrid cloud. The use of public cloud appears to have peaked in our November 2018 survey at 51%, while this year, it dropped to 36%. Private cloud held steady, 42% versus 43% in November 2018. Hybrid cloud, a new option for this year, emerged at 39%.

Cloud Native Projects

CNCF stewards a large number of open source projects critical to the development, deployment, and lifecycle management of cloud native. CNCF projects are growing exponentially in China. For example, the Prometheus monitoring and alert system is used by 57% of respondents, up dramatically from 16% in March 2018. CoreDNS is now used by 35%, up from 10% in March 2018. The Containerd runtime has also seen staggering growth – up from 3% in March 2018 to 29% at the start of 2019.

CNCF also hosts four projects created in China that are more broadly used in the region. Dragonfly (17% use in production) and KubeEdge (11% use in production) were two of the most used Sandbox projects. Both are now incubating projects. Harbor and TiKV, which are graduated projects, are used in production by 27% and 5%, respectively.

There has been a shift in the perceived benefits of using cloud native projects in production since CNCF’s last China survey:

- Faster deployment times appeared for the first time as the top benefit, cited by 47%.

- Improved scalability retained its earlier, number two position with 35%.

- Cost savings remained third with 33%.

- Improved developer productivity, cloud portability, and improved availability tied for fourth at 31%. In November 2018, availability had been number one and portability number four.

Serverless

Serverless is being used as a hosted platform by 36% and as installable software by 22% of respondents in the China survey.

For those using serverless tools as a hosted platform, the top-three providers are Alibaba Cloud Function Compute (46%), AWS Lambda (34%), and a tie between Tencent Cloud Serverless Cloud Function and Huawei FunctionStage (12%).

For those using serverless tools as installable software, Kubeless came first at 29%, followed by Knative at 22%, and Apache OpenWhisk at 20%.

For 2019 we added new questions on cloud native storage and service mesh. These are the popular cloud native projects underpinning these benefits in active production environments:

Storage

The most used cloud native storage projects are Ceph (24%), Amazon Elastic Block Storage (EBS) (23%) and Container Storage Interface (CSI) (18%)

Service Mesh

The Cloud Native Community in China

CNCF now has nearly 50 members in China. China is also the third-largest contributor to CNCF projects (in terms of contributors and committers) after the United States and Germany.

We have several case studies from China-based companies, including:

- JD.com, which saves approximately 60% of maintenance time for its private image central repository with Harbor.

- China Minsheng Bank, which has increased delivery efficiency by 3-4x, and doubled resource utilization with Kubernetes.

- Ant Financial, which has seen at least tenfold improvement in terms of the operations with cloud native technology.

We also launched a Kubernetes and Cloud Native course in China taken by 20,000+ people, and recently finished the first Cloud Native + Open Source Virtual Summit China.

The China community learns about cloud native technologies in many different ways.

Documentation

72% of China survey respondents learn about cloud native technologies through documentation. Each CNCF project hosts extensive documentation on their websites, which can be found here.

CNCF invests thousands of dollars per year in improving project documentation. This includes project documentation hosting, adding tutorials, how-to guides, and more.

Events

Events are a popular way for respondents to learn about cloud native technologies.

41% of respondents selected KubeCon + CloudNativeCon as somewhere to learn about new technologies. The next virtual KubeCon + CloudNativeCon is scheduled for November 17-20.

Meetups and local events, like Cloud Native Community Groups, were selected by 37% of respondents as a way to learn about cloud native technologies.

Webinars

22% of respondents learn about cloud native technologies through technical webinars, with another 8% selecting business-oriented webinars, and 8% selecting CNCF webinars.

CNCF has ramped up its webinar program, with regular webinars scheduled for Chinese audiences. You can see the upcoming schedule and view recordings, slides, and replays of previous webinars here.

About the Survey Methodology & Respondents

A huge thank you to everyone who participated in this survey!

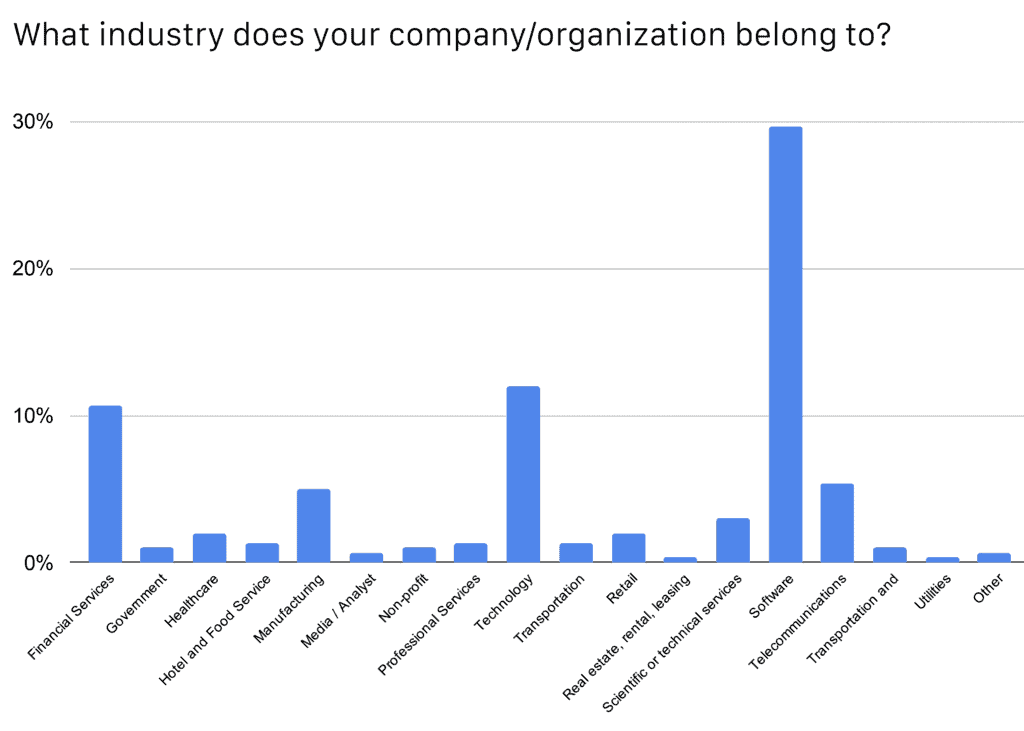

The survey was conducted in October 2019. It was conducted in Mandarin, with 97% of the 300 respondents coming from Asia.

For enquiries, product placements, sponsorships, and collaborations, connect with us at [email protected]. We'd love to hear from you!

Our humans need coffee too! Your support is highly appreciated, thank you!