Today, more than half of grocery sales are influenced by digital, but only 4% of those sales are actually completed online, according to Deloitte research1. That leaves a tremendous growth opportunity for grocers to gain their share of digital shoppers. A one-stop-shop experience is preferred by consumers as it benefits both their time and wallet and offers numerous synergies to the grocer as well. While aggregators present growing competition, Google research shows that the majority of consumers still start with their neighborhood grocer, and would select those stores they already visit2. Of those digital visits, research shows at least 40% (and rapidly growing) will be using search. Pair that with the fact that conversions using search are 50% higher than without3 gives enough evidence that prioritizing search would be one of the key ingredients to success.

Here we review the overall recipe your onsite search should follow to create a delightful experience for your shopper:

From our partners:

Findable

According to KISSMetrics4 12% of shoppers will bounce to a competitor’s site when encountering irrelevant results. Precision is critical when the shopper knows what they need –such as specific ingredients for a recipe, a specific product name, or even a stock keeping unit (SKU). The way a shopper describes the items may vary from the way it is labeled, making it all the more important to incorporate smart search technology to bridge the gaps. The way the queries are being entered is also evolving towards more hands-free methods like voice or photo search. Vector based search technology provides a mechanism to uncover substitute items when a specific item is available, as well as complimentary items to complete a meal. Recommenders and merchandising algorithms should be leveraged to showcase a store’s differentiators such as specialty, house brand or unique products related to the shopper’s search intent.

Providing more usability through shopping tools leveraging search can help stores differentiate against aggregators. In addition to the preference to visit the local and same stores, research5 shows that the repurchase rate of items is much higher in grocery than in other ecommerce verticals. Basing results off previous orders such as “buy it again” and influencing results based on the characteristics of past orders is what shoppers want. Convenience tools such as grocery list uploads and smart extraction of products from recipes drive benefits to both new and existing shoppers. When shoppers decide to come into stores, using search to help shoppers physically locate items in the store is a tool to win shoppers with a high sense of urgency.

Discoverable

40% of shoppers say online is better than in-person at helping them discover new products, according to The Food Industry Association6. When shoppers are not quite sure of what items they need, all that the store carries, or what they are called (such as keywords to use) they will lean more on navigation and browsing. This mirrors the behavior shoppers exhibit perusing store aisles. The digital experience can elevate that of the stores through dynamically personalized navigation and browsing experiences using search. These drive a more empathetic experience that listens and adjusts to the shoppers’ intent, such as reshuffling aisles based on the shoppers’ diet and ingredient preferences. Introducing recommenders and chatbots through browsing simulates the in-store experience as shoppers frequently interact with other shoppers as well as store floor staff to get recommendations. These can be influenced by the individual shoppers’ intent signals and those of other similar shoppers. You also want shoppers to find your products on external search engines. For example, smart enrichment can be used to augment the depth of information on navigation and browse pages for a specific item or category. Vector search and recommenders can also be used to nudge based on store-specific targets, such as relevant house brands or generics as substitutes based on the shopper’s browse patterns. This is particularly valuable in the era of rising costs and the growth of cost-conscious consumers.

Informative

Provide a rich set of information to help the shopper make a decision which may include not only that of the manufacturer but also from the community of users. This does more than help the shopper – it aids in shoppers finding your products organically on search engines. Machine learning models can marry shopper signals with the underlying information provided to them (such as ingredients and recipes) to inform models such as recommenders and personalization–and to generate insights. These signals can arrive from third-party sources such as diet and health/fitness apps if the shopper gives permission for sharing.

Below are examples of common data points such as calorie count, carb and fat intake, and diet goals being followed in apps.

Datapoints can also be extracted from nutrition and recipe labels using ML based entity detection and topic extraction. This eliminates the need for traditional data manipulation and enrichment mainly when product attributes and details are sparse. User-generated content such as reviews, posts, and videos can also be valuable sources to supplement the knowledge available around the product.

Pairing signals with entity detection and available product attributes can yield shopper intent. This can be used to drive individual real time relevance such as the sorting of products based on affinity to ingredients:

Shopper Views Underlying Product Attributes ML Derived Shopper Intent

| Product | Barilla, Corn Flour, Rice Flower | Gluten Free, Brand = Barilla |

| Ingredients | Oregano, Olive Oil, Garlic | Mediterranean Diet |

| Dietary Facts | No Cholesterol, 0 Sat Fat | Heart Healthy |

| Wild Caught Shrimp | Organic, Sustainable | Green Consumer |

Illuminated

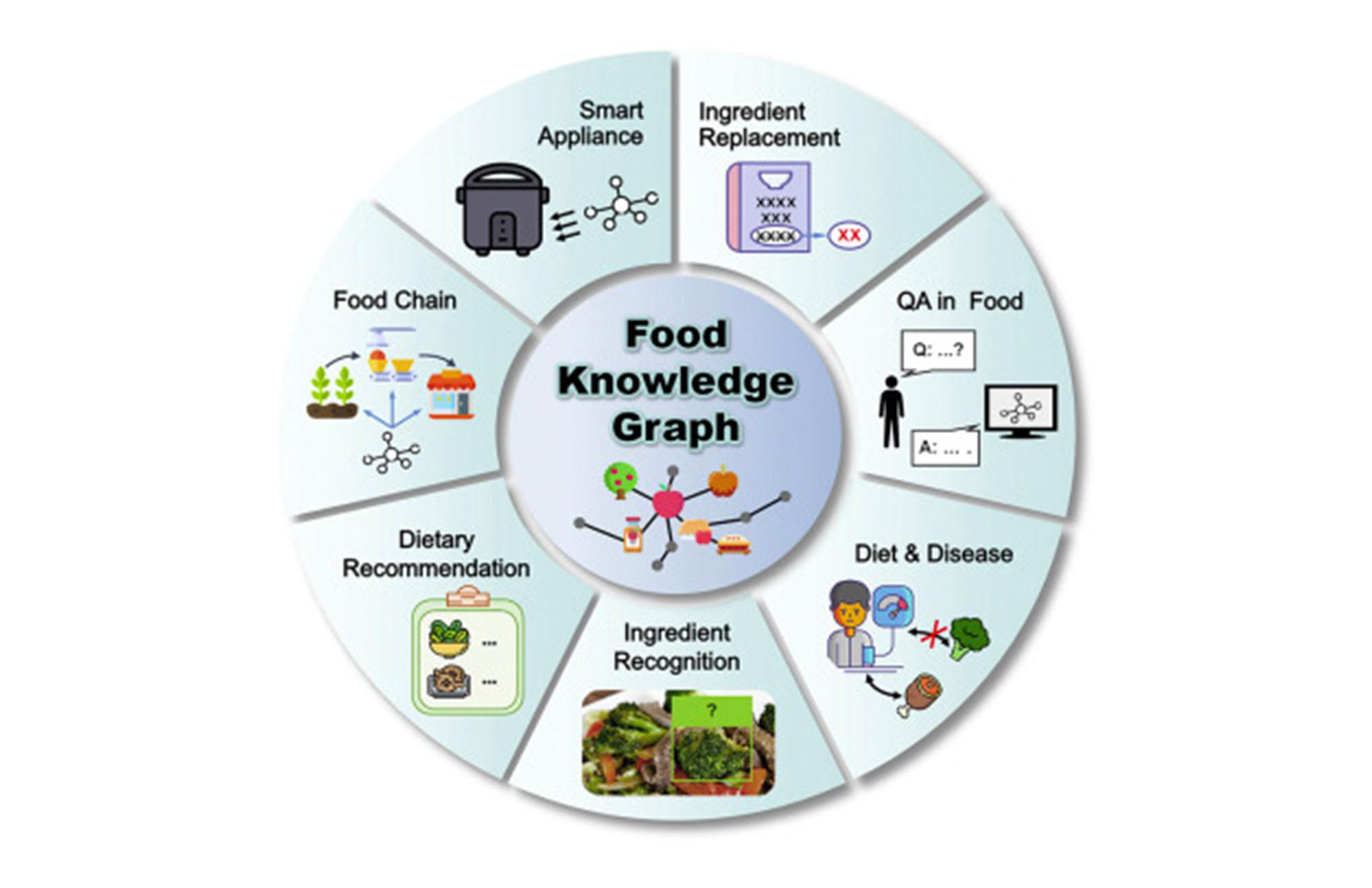

Search engines can be pre-trained with knowledge graphs such as a food knowledge graph so it is already aware of the relationships between entities and topics for the given market. This can also be used to generate additional labeling and tagging for product enrichment. Diet plans such as Keto, Dash, Mediterranean, and Vegan can be managed in these graphs for use across the shopper journey. This can also help surface items to the shopper they may have not considered or are aware of driving both conversion and revenue. Deep learning technologies such as computer vision can be applied to user-generated images, such as photos of plates, to extract trends to enrich search.

Vector search can be applied to present items based on their topical distance. In grocery this would mean finding alternatives to out-of-stock items based on the query, or complimentary items to a query such as meal or recipe detection. While vector search is primarily driven by keyword input, recommendations would generally be based on the underlying result such as a landing page, product detail page, or shopper states such as what is in their cart.

Personalized

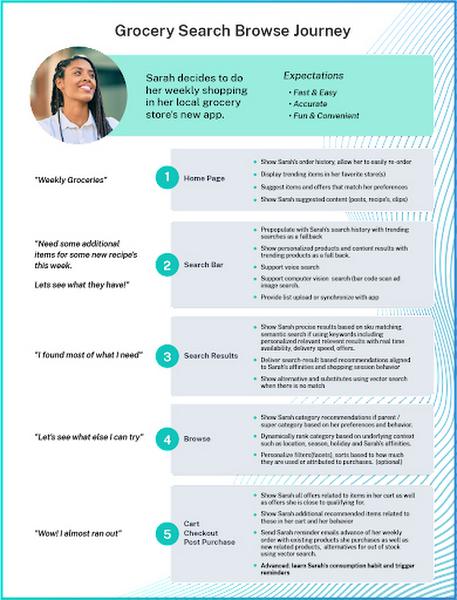

Search should align to the shopper based both on their current behavior and if their given preferences are available. As discussed in the Informative section, marrying shopper signals to underlying data points such as ingredients, nutrition, and product details will provide preference and affinity data to incorporate into how results are shown. Inference models using knowledge graphs including diet data and corresponding collaborative shopper behavior can be used to detect a specific diet plan the shopper is following. Individual preferences shared through a profile, such as allergies and dietary restrictions, can also be used to filter results so irrelevant products are not shown. Personalization is shown to have a significant positive impact when applied across the search journey. The diagram below shows some common practices of employing personalization in grocery:

Connected

Connected experiences between the store and digital touchpoints such as apps, email, webstore and campaigns are essential. Research9 indicates that 61% of shoppers are willing to share personalization for a more relevant, personalized experience or one that drives convenience. Most touchpoints such as health and nutrition apps, e-commerce platforms, and customer/marketing platforms have the ability to exchange data with each other or through a central customer repository (such as a customer data platform). This can bring tremendous value to the shopper as 91% of shoppers are likely to make a repeat purchase if they feel heard10. Consider integrating these sources, particularly apps as a gateway to land new customers and further engage existing ones. Connecting back office systems, such as supply chain and inventory, are also important to drive more traffic – particularly for impulse / high urgency buyers who may otherwise go with an aggregator. Maintaining a continuous conversation across sessions and touchpoints regardless of where the experience starts or ends is now a necessity.

It’s all in the presentation

Presentation is equally important whether it is a meal or an experience. While the focus has been on underlying results shown to shoppers, it is important to focus on the presentation of those results. For example, highlighting ingredients important in the shopper’s decision in results can dramatically assist in decision making. If the shopper named specific ingredients in their search, the results are significantly more usable when those ingredients are highlighted. If the shopper’s preferences or inferred affinity to specific features of the product are used they should be highlighted as well. App and page real estate is limited, ordering results and navigation based on utility to the user, therefore, becomes all that more important.

1. Bridging the grocery digital divide – Deloitte Research

2. How omnichannel grocers can win as shopping moves online – Think With Google

3. Four reasons why site search is vital for online retailers

4. What Is Time On Site? Everything You Need to Know – KISSMetrics

5. Grocery and Food Delivery Site UX – Baymard

6. Has online grocery shopping hit its sales ceiling? – Retail Wire

7. Image source LiveStrong MyPlate App

8. Image courtesy of Science Direct

9. Most are concerned about data privacy, but few are willing to change habits – Helpnet Security

10. Data Privacy Versus Personalization: How Do Consumers Really Feel? – AdTaxi

By: Sanjay Mehta (Head of Industry, Lucidworks) and Matt Sullivan (Global Head of Strategic Partnerships, Google Cloud)

Source: Google Cloud Blog

For enquiries, product placements, sponsorships, and collaborations, connect with us at [email protected]. We'd love to hear from you!

Our humans need coffee too! Your support is highly appreciated, thank you!